Small Business Accountants for Dummies

Wiki Article

The Best Strategy To Use For Small Business Accountants

Table of ContentsExamine This Report on Small Business AccountantsThe 25-Second Trick For Small Business AccountantsSome Known Factual Statements About Small Business Accountants The Ultimate Guide To Small Business AccountantsA Biased View of Small Business AccountantsThe 3-Minute Rule for Small Business Accountants

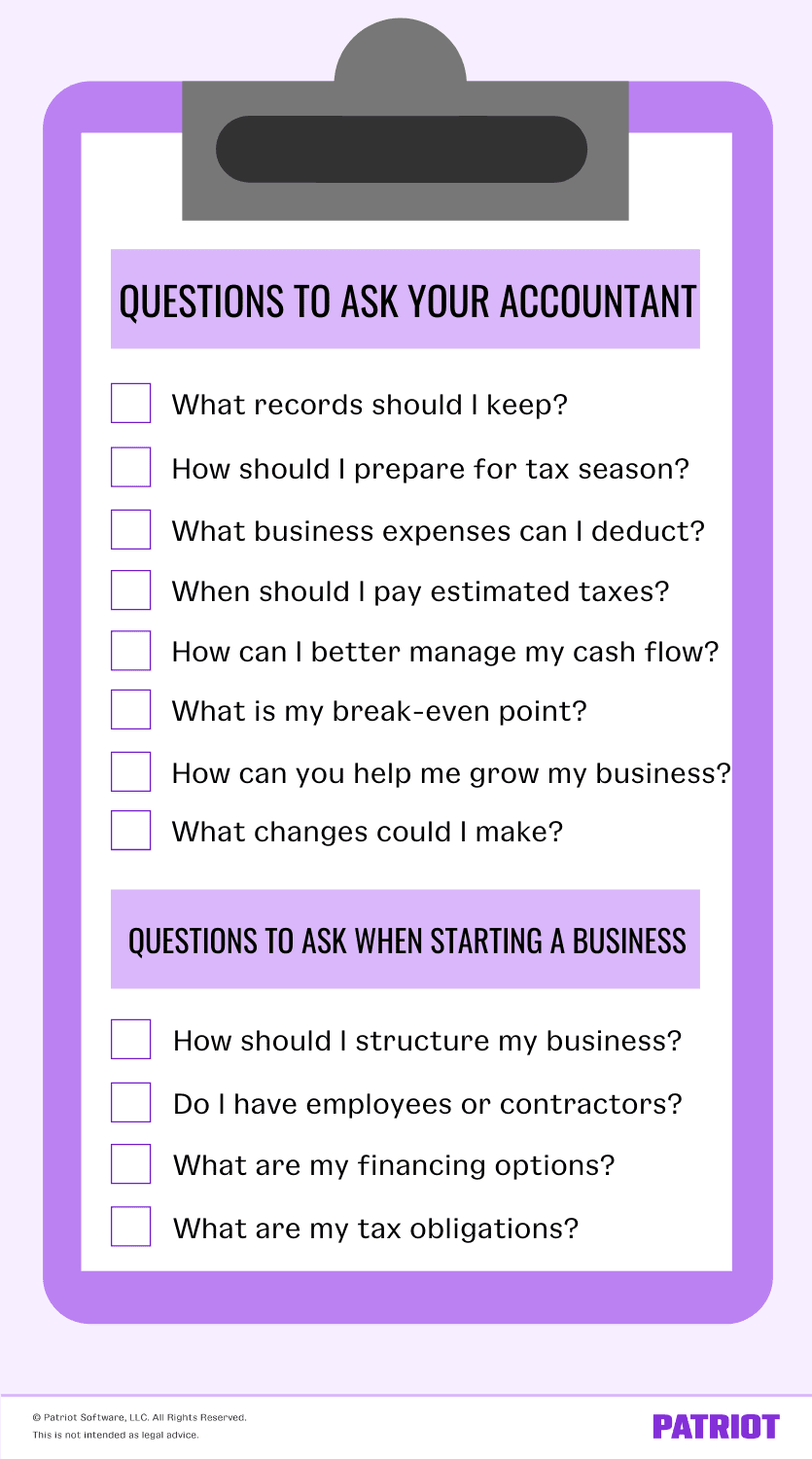

One area you might take into consideration doing it yourself instead of employing it out is accounting.The Startup Process When you begin a business, there are lots of activities you need to take and systems you need to set up to develop the structure for a successful service. An accountant can aid by: Figuring out the very best organization framework (i. e., sole proprietorship, LLC, company, partnership) for your scenario.

These are simply some of the ways accountants can work with tiny organization owners. You can choose to work with an accountant for all of your monetary activity, or you can choose a mixed technique that restricts his or her hands-on activity, reducing the cost.

The 8-Second Trick For Small Business Accountants

One of the most important thing you can do when it concerns your business financial resources is to acknowledge when you need to employ the help of an expert, and afterwards locate an accounting professional who will aid preserve the financial health and wellness of your service.

Read Should I Work With An Accountant For My Small Organization? You must employ an accounting professional for your little company when you need assistance with the collection, evaluation as well as coverage of financial information.

This is so the info can be reported on properly to business proprietors, investors (if you have them) and the federal government. The accountant would certainly additionally make certain that proper treatments remain in place for information entrance and also that the accounting software program system being used is modern-day, protected and supported routinely.

Examine This Report about Small Business Accountants

There's a reason for that. When it comes to choices including the future of your small service, your accountant might often be your best resource. Possibly you need some basic suggestions on just how to wage spending in the next quarter, or probably there's a situation regarding a big expense and also you want to talk about choices for credit rating or tax reductions, or possibly you simply need aid analyzing a few of the economic lingo in a file.Financial Information Ever before became aware of a "Cash Flow Declaration" or a "Profit as well as Loss Report"? These are the kinds of reports that enable you to maintain updated on the company's money. You or your capitalists are mosting likely to be choosing based upon the records your accountant gives, so he/she demands to ensure they depend on date and precise.

Can I Do My Own Accountancy? Yes, you can do your very own audit for your small company, many owners do just that. As your business grows, and also there is even more need for your time throughout your working day, you might discover you you can find out more require the support of an accounting professional. Afterall, an accounting professional will have a strong history in math and business economics, in addition to experience with the most effective audit techniques, treatments, as well as devices you can utilize.

Our Small Business Accountants Diaries

Just How Can I Locate a Small Company Accounting Professional? Below's where you want to be extremely cautious as well as step gradually - small business accountants. You do not desire to hurry with the process of employing an accountant, as this person is mosting likely to have accessibility to all your company's monetary details. You want someone capable and also credible, as well as worth the money you're going to invest.Ask Associates Concerning Their Accounting Professional Opportunities are you understand a couple of individuals running their very own little services that sometimes state their accounting professional. Call them. See who they use and also if they're pleased with the solutions being supplied. Were tasks finished on schedule? Were the records detailed and precise? Were there any troubles? Think About a Licensed Public Accountant Not everybody is a CERTIFIED PUBLIC ACCOUNTANT, yet employing one implies you have someone that has actually passed the challenging CPA test, has the necessary work experience as well as who will certainly continue to enroll to keep this classification.

10 Simple Techniques For Small Business Accountants

Accountants are not Financial Advisors. Exactly how Much Does an Accounting Professional Expense a Small Business?Some tiny businesses require just standard accountancy help which ought to be shown in the price paid. It's best to detail out ahead of time precisely what your requirements are, examine it with your group for input, as Learn More well as when you find somebody you such as, estimate it out initially and see if there is space This Site for settlement.

Getting The Small Business Accountants To Work

Do you require an accountant or a bookkeeper? Here's what you need to recognize prior to positioning that aid desired advertisement.Report this wiki page